Inflation—Good News, Bad News

The U.S. Bureau of Labor Statistics (BLS) reported on inflation last week with the release of the April Consumer Price Index (CPI). We’ll get into the headline numbers in a moment, but the report can be summarized with two graphs, which suggest both good news and bad news.

First, the good news. Early on, inflation was driven by a surge in the cost of consumer goods. As Figure 1 illustrates, prices jumped 0.8% in April 2021. But the recent trend is encouraging.

Although used vehicles are not included in Figure 1 (and prices remain elevated), used cars have fallen over the last three months, per U.S. BLS data.

While we can be cautiously optimistic that the rate of inflation for consumer goods is slowing, the same can’t be said for the broad-based service sector.

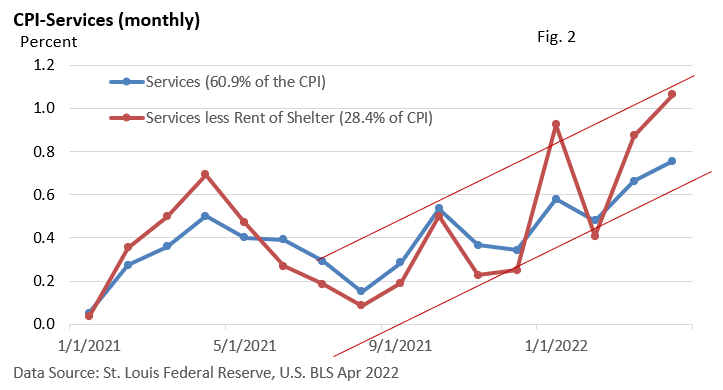

As Figure 2 illustrates, the cost of services is accelerating. Services rose almost 0.8% last month (blue line). If rent, which has been rising, is removed, services jumped nearly 1.1% (red line).

Further, energy prices remain a problem, and food continues to rise.

Overall, the U.S. BLS reported the CPI slowed from an annual pace of 8.5% in March to 8.3% in April, and the core CPI, which excludes food and energy, slowed from 6.5% annually to 6.2%.

Yet, both were disappointing, as they remain high and overshot expectations, per Bloomberg.

For now, the Fed has its work cut out as they attempt to slow an overheated economy and rein in inflation, without tipping the economy into a recession.

As Fed Chief Jerome Powell said last week in an interview with Marketplace, “Whether we can execute a soft landing or not, it may actually depend on factors that we don’t control.”

If you have any questions or would like to discuss any other matters, please let me know.

Clark S. Bellin, CIMA®, CPWA®, CEPA

President & Financial Advisor, Bellwether Wealth

402-476-8844 cbellin@bellww.com

All items discussed in this report are for informational purposes only, are not advice of any kind, and are not intended as a solicitation to buy, hold, or sell any securities. Nothing contained herein constitutes tax, legal, insurance, or investment advice. Please consult the appropriate professional regarding your individual circumstance.

Stocks and bonds and commodities are not FDIC insured and can fall in value, and any investment information, securities and commodities mentioned in this report may not be suitable for everyone.

U.S. Treasury bonds and Treasury bills are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury bills are certificates reflecting short-term (less than one year) obligations of the U.S. government.

Past performance is not a guarantee of future results.

Different investments involve different degrees of risk, and there can be no assurance that the future performance of any investment, security, commodity or investment strategy that is referenced will be profitable or be suitable for your portfolio.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material.

The information contained is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Before making any investments or making any type of investment decision, please consult with your financial advisor and determine how a security may fit into your investment portfolio, how a decision may affect your financial position and how it may impact your financial goals.

All opinions are subject to change without notice in response to changing market and/or economic conditions.

1 The Dow Jones Industrial Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2 The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3 The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4 The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5 CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6 CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.