Biggest Rate Hike in Over 20 Years, but More Aggressive Path Quashed

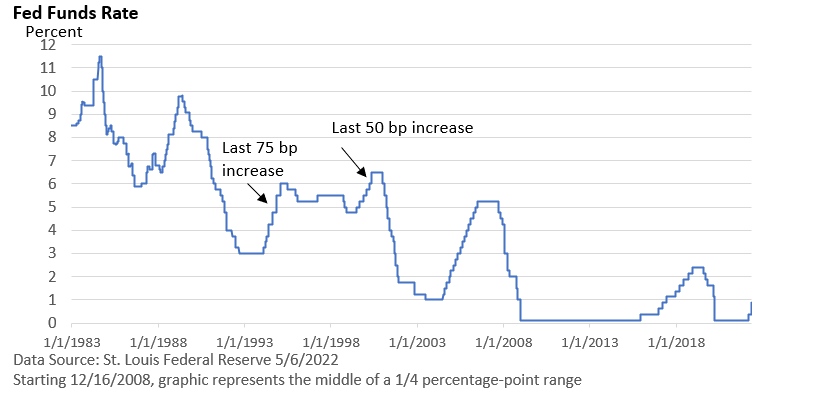

As widely expected, the Federal Reserve hiked its key lending rate, the fed funds rate, by 50 bp (basis points, 1 bp = 0.01%) to a range of 0.75—1.00%. It is the first 50 bp rate hike in over 20 years. As it detailed in its statement, the Fed will also begin letting some of the bonds it acquired in the pandemic runoff its balance sheet starting in June. This was also expected.

The rate increase was no surprise, and there wasn’t an immediate market reaction. Instead, it was comments that came in the press conference that moved the market.

In response to a question, Powell said a 75 bp rate hike “is not something the committee is actively considering.” That was a surprise. He could have kept his options open.

Instead, 50 bp over the next two meetings “should be on the table.” Removing 75 bp sparked a big rally on Wednesday, but Powell may have inadvertently set the stage for Thursday’s selloff.

By pouring cold water on a 75 bp rate hike, the Fed may have sparked Thursday’s turbulent jump in bond yields. A slightly less hawkish message is the opposite of what is needed to combat inflation, and bond investors reacted.

The Fed may be looking at the shrinking balance sheet in lieu of bigger rate hikes. Powell did not elaborate.

Other notable remarks: Powell said he sees a “good chance to have a soft or softish economic landing.” Softish? He didn’t explain. Did he mean a mild recession? It’s not clear.

He also said the Fed “won’t hesitate to deliver” higher rates and tackling inflation “is not going to be pleasant.” Yet, 75 bp appears to be off the table.

Broader view

Today, the Fed’s focus is on inflation. Should rates have been raised rates last year? Is the Fed behind and trying to catch up? These are philosophical questions being asked to try and justify market sentiment and today’s mood.

Historically speaking, rates remain low, but they are becoming less supportive of growth and may eventually restrict growth. That seems to be where the Fed is headed.

The Fed can slow overall demand in the economy, and slower demand for goods and services can slow inflation. But supply issues like oil, natural gas, wheat, semiconductors, and China COVID lockdowns are outside its control.

What might it take to reduce bearish sentiment?

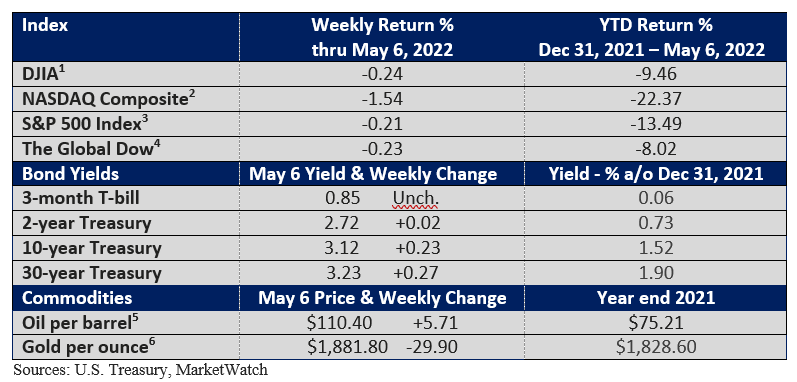

The S&P 500 Index is down 14% from its Jan. 3 peak (St. Louis Fed Reserve). Since 1980, the average annual peak-to-trough pullback in the index is 14%, according to LPL Research. While stocks climb the ladder over the long-term, volatility isn’t unusual. Yet, it can be unnerving.

What’s needed? It will help investors to focus on the data and ignore headlines. Today, investors want to see signs that inflation is peaking and on a downward path. Why? Slower inflation reduces the need for steep rate increases, which have created stiff headwinds for stocks.

Powell said the Fed is seeing some evidence that core inflation, which excludes food and energy, “is perhaps reaching a peak or flattening out. We want to see more than just some evidence.”

But the Fed is hoping to slow inflation without tipping the economy into a recession. They will need skill and some luck. The strong dollar could help with the price of imported goods, but the economy needs fewer obstructions in the supply chain.

If you have any questions or would like to discuss any other matters, please let me know.

Clark S. Bellin, CIMA®, CPWA®, CEPA

President & Financial Advisor, Bellwether Wealth

402-476-8844 cbellin@bellww.com

All items discussed in this report are for informational purposes only, are not advice of any kind, and are not intended as a solicitation to buy, hold, or sell any securities. Nothing contained herein constitutes tax, legal, insurance, or investment advice. Please consult the appropriate professional regarding your individual circumstance.

Stocks and bonds and commodities are not FDIC insured and can fall in value, and any investment information, securities and commodities mentioned in this report may not be suitable for everyone.

U.S. Treasury bonds and Treasury bills are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury bills are certificates reflecting short-term (less than one year) obligations of the U.S. government.

Past performance is not a guarantee of future results.

Different investments involve different degrees of risk, and there can be no assurance that the future performance of any investment, security, commodity or investment strategy that is referenced will be profitable or be suitable for your portfolio.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material.

The information contained is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Before making any investments or making any type of investment decision, please consult with your financial advisor and determine how a security may fit into your investment portfolio, how a decision may affect your financial position and how it may impact your financial goals.

All opinions are subject to change without notice in response to changing market and/or economic conditions.

1 The Dow Jones Industrial Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2 The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3 The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4 The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5 CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6 CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.