Interest Rates - Higher for Longer

“Good afternoon. My colleagues and I are strongly committed to bringing inflation back down to our 2 percent (annual) goal. We have both the tools we need and the resolve it will take to restore price stability on behalf of American families and businesses.”

Fed Chief Powell’s opening statement set the tone for his Wednesday press conference. It was Powell on steroids.

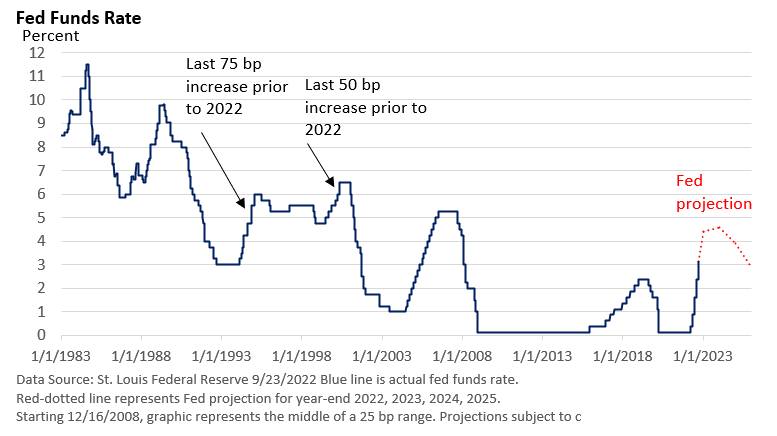

It isn’t simply rhetoric. The Federal Reserve boosted the fed funds rate by 75 basis points (bp, 1 bp = 0.01%) to 3.00-3.25%. It’s the third-straight 75 bp rate hike.

It’s the fastest series of rate hikes since 1980, when the Fed jacked up the fed funds rate by an astounding 1,000 bp in six months (to nearly 20%), according to St. Louis Federal Reserve data.

Though Powell opened the door to an eventual slowdown in the pace of rate increases, the June forecast of a year-end fed funds rate of 3.4% was lifted to 4.4% (red line), and to 4.6% from 3.8% by the end of 2023. It’s not simply the level, but it tilts in an even more hawkish direction.

What is the Fed trying to accomplish?

By raising interest rates, it wants to slow demand in the economy and bring it back in line with supply, which historically has slowed inflation.

In addition, a weaker economy reduces the number of job openings and boosts layoffs, which limits inflationary wage hikes. It’s not without pain and may create risks in the financial sector.

Powell was explicit in his desire to slow the economy. In fact, the Fed is forecasting a rise in the unemployment rate to 4.4% by the end of 2023, up from 3.7% today (U.S. Bureau of Labor Statistics). But let’s not put too much stock in Fed forecasts.

It failed to call the sharp upturn in the economy following the lockdowns, it missed badly last year on its outlook for inflation, and last year’s projection of just one increase in the fed funds rate in 2022 is an embarrassment.

Final thoughts

Price stability is the bedrock of a healthy economy. For starters, the economic expansion of the 1990s and the 2010s, the longest expansions on record per the National Bureau of Economic Research (data pre-dates the Civil War), was assisted by low inflation.

And inflation eats away at savings.

The Fed’s desire to bring inflation down signals rates could stay higher for longer, and it will depend on how long it takes to get a handle on inflation.

If you have questions or would like to discuss any other matters, please let me know.

Clark S. Bellin, CIMA®, CPWA®, CEPA

President & Financial Advisor, Bellwether Wealth

402-476-8844 cbellin@bellww.com

All items discussed in this report are for informational purposes only, are not advice of any kind, and are not intended as a solicitation to buy, hold, or sell any securities. Nothing contained herein constitutes tax, legal, insurance, or investment advice. Please consult the appropriate professional regarding your individual circumstance.

Stocks and bonds and commodities are not FDIC insured and can fall in value, and any investment information, securities and commodities mentioned in this report may not be suitable for everyone.

U.S. Treasury bonds and Treasury bills are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury bills are certificates reflecting short-term (less than one year) obligations of the U.S. government.

Past performance is not a guarantee of future results.

Different investments involve different degrees of risk, and there can be no assurance that the future performance of any investment, security, commodity or investment strategy that is referenced will be profitable or be suitable for your portfolio.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material.

The information contained is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Before making any investments or making any type of investment decision, please consult with your financial advisor and determine how a security may fit into your investment portfolio, how a decision may affect your financial position and how it may impact your financial goals.

All opinions are subject to change without notice in response to changing market and/or economic conditions.

1 The Dow Jones Industrial Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2 The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3 The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4 The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5 CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6 CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.