Inflation Soars, but Is It Peaking?

A 1.2% rise in the Consumer Price Index last month was the biggest increase since 2005, according to the U.S. Bureau of Labor Statistics. Given the spike in energy tied to the Russia-Ukraine war, March’s inflation report was no surprise.

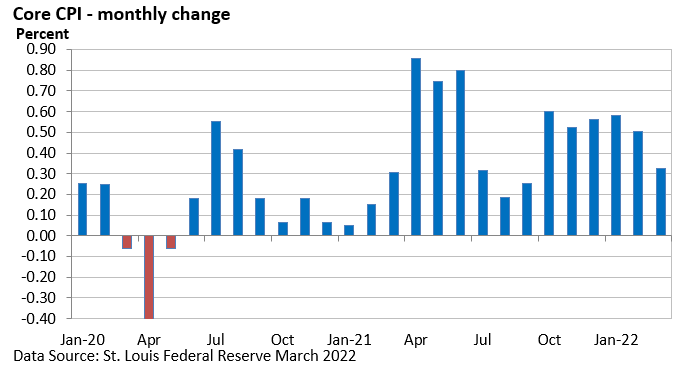

A 0.3% rise in the core CPI, which excludes food and energy, was cautiously encouraging.

The core CPI came in light thanks to a 3.8% decline in used car and truck prices.

But services, which account for over 60% of the CPI (U.S. BLS), rose a troubling 0.7% last month. It was the largest increase in 15 years.

Furthermore, the Producer Price Index, which measures inflation at the wholesale level, also accelerated (U.S. BLS).

Demand-pull, cost-push

Economists usually cite two reasons for inflation: demand-pull and cost-push.

Demand-pull inflation is generated as strong demand for goods and services outpaces the ability of businesses to provide those products and services. Therefore, prices rise.

Cost-push inflation occurs amid higher prices or shortages of raw materials. In turn, businesses pass along those higher prices to consumers.

Today, we’re experiencing both. If we turn the page back to the initial lockdowns, non-essential businesses closed and most of us stayed at home.

When the economy began to reopen, consumers, who were flush with stimulus cash, started spending, but reopening manufacturing facilities at home and abroad remains a challenge.

A year ago, the Wall Street Journal detailed the problems a Utah factory faced as it cranked out hot tubs.

“Parts come from seven countries and 14 states and travel a cumulative 887,776 miles to make one hot tub, the company estimates,” the Wall Street Journal said. At the time, it could take up to “six months for a customer to get a hot tub, up from a few weeks before the pandemic.”

Problems in the supply chain are still with us. Given the drawn out manufacturing process, you can see how parts and labor shortages can gum things up.

The Fed has little control over the supply chain, the shortage of semiconductors, or rising food prices. But it can deal with demand-pull inflation by lifting interest rates and slowing down economic growth, which could help to re-align demand with supply.

If you have any questions or would like to discuss any other matters, please let me know.

Clark S. Bellin, CIMA®, CPWA®, CEPA

President & Financial Advisor, Bellwether Wealth

402-476-8844 cbellin@bellww.com

All items discussed in this report are for informational purposes only, are not advice of any kind, and are not intended as a solicitation to buy, hold, or sell any securities. Nothing contained herein constitutes tax, legal, insurance, or investment advice. Please consult the appropriate professional regarding your individual circumstance.

Stocks and bonds and commodities are not FDIC insured and can fall in value, and any investment information, securities and commodities mentioned in this report may not be suitable for everyone.

U.S. Treasury bonds and Treasury bills are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury bills are certificates reflecting short-term (less than one year) obligations of the U.S. government.

Past performance is not a guarantee of future results.

Different investments involve different degrees of risk, and there can be no assurance that the future performance of any investment, security, commodity or investment strategy that is referenced will be profitable or be suitable for your portfolio.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material.

The information contained is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Before making any investments or making any type of investment decision, please consult with your financial advisor and determine how a security may fit into your investment portfolio, how a decision may affect your financial position and how it may impact your financial goals.

All opinions are subject to change without notice in response to changing market and/or economic conditions.

1 The Dow Jones Industrial Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2 The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3 The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4 The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5 CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6 CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.