Inflation Stays Hot

Talk of peak inflation appears to have been premature following the latest release of the CPI.

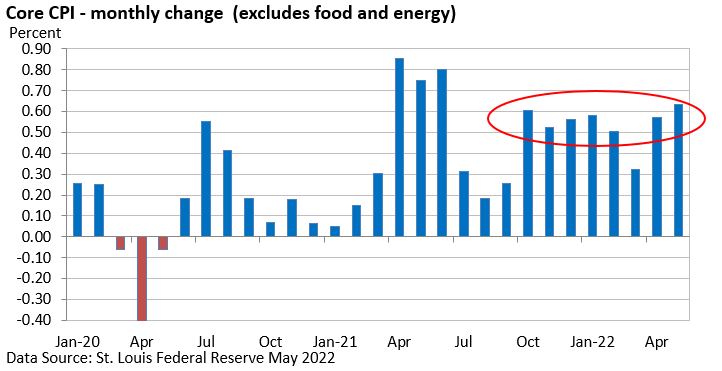

The Consumer Price Index rose 1.0% in May, and the core CPI, which excludes food and energy, rose 0.6%, according to the U.S. Bureau of Labor Statistics (BLS). The CPI and core CPI exceeded expectations of 0.7% and 0.5%, respectively, per Dow Jones Newswires.

Annually, the CPI hit a fresh 40-year high of 8.6% vs 8.3% in April, and the core CPI slowed to 6.0% from 6.2% in April.

The inflation narrative changed little over the last month. U.S. Bureau of Labor Statistics (BLS) data highlighted that inflation has moderated for most consumer goods, but services, food, and energy remain a big problem.

The Producer Price Index, which measures wholesale inflation, showed no signs of easing when it was last released a month ago—April data, U.S. BLS.

A Bloomberg News story early last week pointed out that some measures of semiconductors, shipping containers, and fertilizer prices have come down.

Business Insider noted that lumber prices have tumbled recently, but we’re not seeing anecdotal evidence of slowing inflation creep into the broad-based CPI in a major way.

Look at the graphic below. Inflation outside of food and energy has roughly held within a 0.5—0.6% range in seven of the last eight months. The temporary slowdown in March occurred primarily due to a steep drop in used cars.

Bottom line

Investors have yet to see a peak in inflation, which raises the odds that the Fed will continue to take aggressive action.

However, our friends at ITR Economics (www.itreconomics.com) are seeing a few events and trends of which to take notice. ITR Economics is not in the camp that thinks oil is going to $150 - $175 bbl. That projection smacks of straight-line forecasting that ignores that global growth is slowing (therefore demand is slowing) and that OPEC output is slated to rise. ITR Economics reports it is getting tentative, but promising, upside signals regarding the general economy for the second half of 2023.

If you have any questions or would like to discuss any other matters, please let me know.

Clark S. Bellin, CIMA®, CPWA®, CEPA

President & Financial Advisor, Bellwether Wealth

402-476-8844 cbellin@bellww.com

All items discussed in this report are for informational purposes only, are not advice of any kind, and are not intended as a solicitation to buy, hold, or sell any securities. Nothing contained herein constitutes tax, legal, insurance, or investment advice. Please consult the appropriate professional regarding your individual circumstance.

Stocks and bonds and commodities are not FDIC insured and can fall in value, and any investment information, securities and commodities mentioned in this report may not be suitable for everyone.

U.S. Treasury bonds and Treasury bills are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury bills are certificates reflecting short-term (less than one year) obligations of the U.S. government.

Past performance is not a guarantee of future results.

Different investments involve different degrees of risk, and there can be no assurance that the future performance of any investment, security, commodity or investment strategy that is referenced will be profitable or be suitable for your portfolio.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material.

The information contained is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Before making any investments or making any type of investment decision, please consult with your financial advisor and determine how a security may fit into your investment portfolio, how a decision may affect your financial position and how it may impact your financial goals.

All opinions are subject to change without notice in response to changing market and/or economic conditions.

1 The Dow Jones Industrial Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2 The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3 The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4 The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5 CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6 CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.